AUTHORS

Andrea Casati

Director Data&AI Financial Services

@BIP xTech

Niccolò Silicani

Senior Data Scientist Financial Services

@BIP xTech

This article is intended to continue the journey in exploring how Artificial Intelligence (AI) revolution is changing the world of Finance. In previous episode, we’ve explored AI’s pivotal role in fraud detection, where its intricate algorithms have bolstered security measures, ensuring safer transactions and protected financial interests. We’ve also delved into its impact on credit risk assessment, precisely predicting probabilities of corporate financial distress and enabling informed lending decisions.

Below, we will explore how harnessing AI in Asset Management transforms the traditional investment journey from a random to a data-driven walk down Wall Street, offering investors unprecedented opportunities guided by new sources of information and mathematical computation.

Market Overview

In the ever-changing landscape of global finance, the past two decades have witnessed the rise and fall of markets, often influenced by the policies of central banks. Accommodative policies have historically driven up equity markets, fostering an environment of growth and stability. However, the tides have shifted. Galloping inflation and recent geopolitical tensions have prompted swift responses from regulators. The outcome? A context characterized by soaring interest rates and pervasive market uncertainty. This unsettling scenario catalysed a recent staggering decline in global assets under management (AuM). The implications of this downturn are profound. Traditional business models, once reliable, are no longer as effective in this volatile environment. Investors and managers find themselves at a crossroads, compelled to explore innovative pathways to profitability amid the stormy seas of market unpredictability.

Challenges

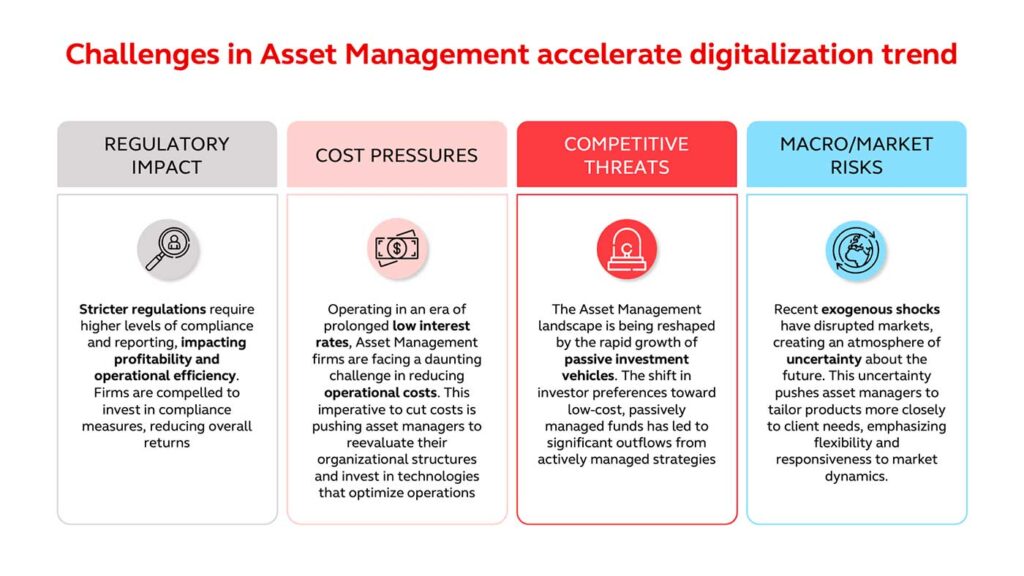

The asset management industry, while essential for global financial stability, faces a myriad of challenges that demand continuous strategic adaptation and innovation. These challenges encompass various facets, fundamentally reshaping how asset managers operate. Understanding these pressures is vital in devising effective strategies, products and services to navigate the intricate landscape of asset management. Let’s explore the key challenges that reverberate across the industry, posing significant hurdles for asset managers worldwide.

Enabling technologies

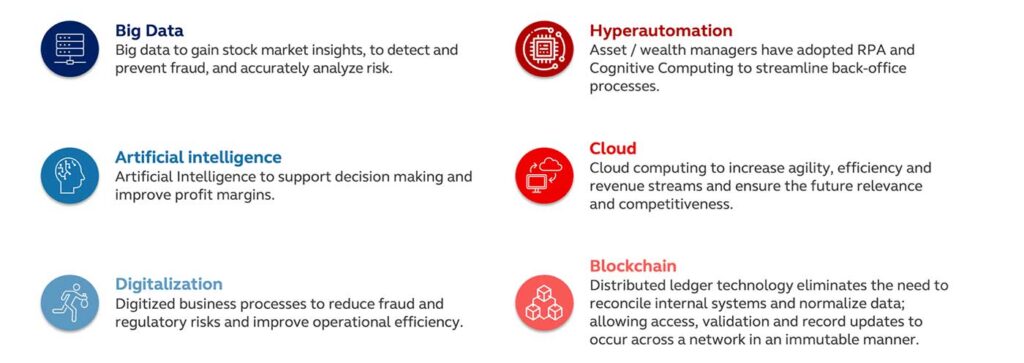

In the face of complex challenges the Asset Management industry is turning to new advanced sources of information, more powerful mathematical models and computation technologies to enhance efficiency, mitigate risks, and deliver superior differentiating services to clients. Among others, Artificial Intelligence (generative and not) and Alternative Big Data are having a disruptive impact on the entire Asset Management value chain.

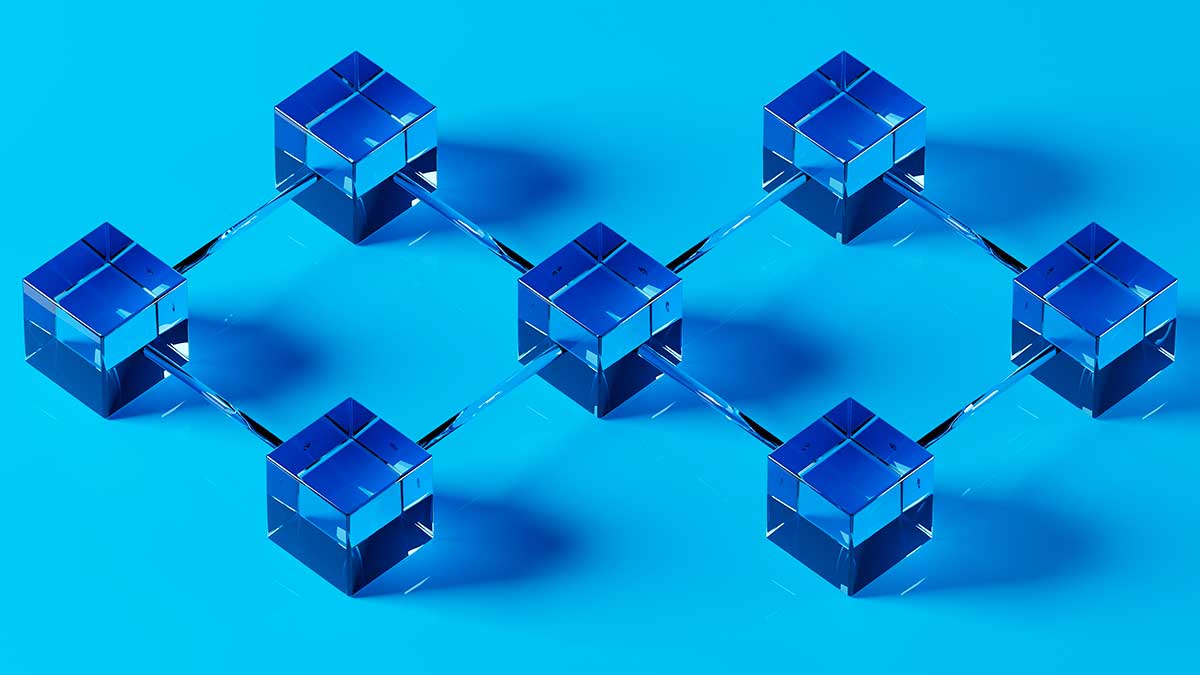

Leveraging Challenges: Opportunities Across Offices

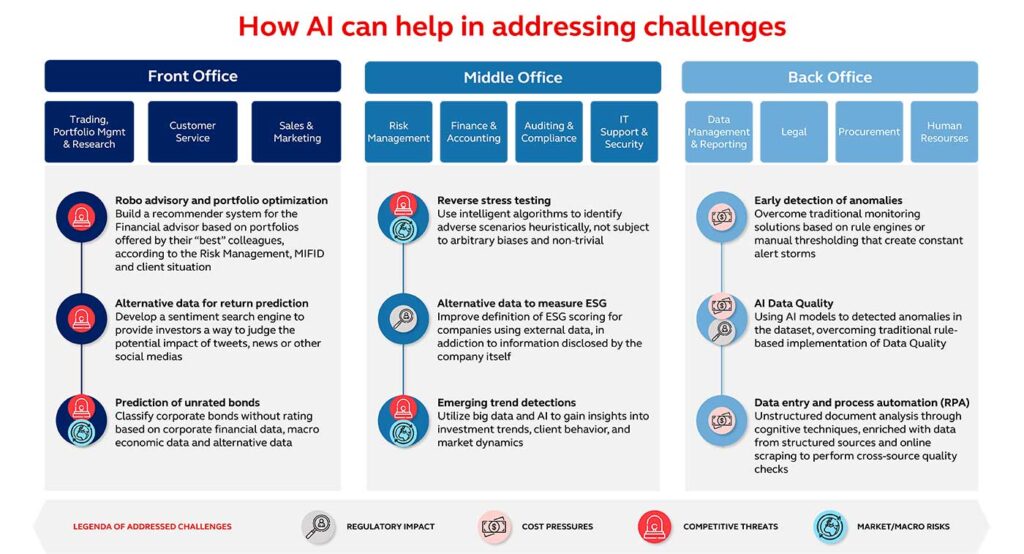

Although the challenges outlined earlier have the potential to destabilize most of players in the industry, they also bring unique opportunities that can be harnessed across all offices. In general, a distinction is drawn in the Asset Management industry between front, middle and back office. The front office engages in client-facing activities and investment decision-making; the middle office handles risk management, compliance, and trade support, and the back office manages administrative tasks, trade settlement, and technology infrastructure, ensuring smooth operations across the firm. In the illustration below, we present a visual representation of how the three offices can view the challenges of the industry as a chance to seize new opportunities. The following table shows a set of selected success stories to support clients across all offices.

This visual representation illustrates few examples of how each office can strategically exploit the challenges they face, transforming them into opportunities that not only address immediate concerns but also foster innovation and long-term competitive advantage throughout the industry’s value chain.

BIP xTech can help

Nowadays, the knowledge of standalone technical tools is no longer sufficient to govern the challenges that arise, but there is a need to modulate these tools with the peculiarities of the business domain. Bip xTech’s specialists are able to integrate AI tools into a range of vertical services proposed to players in different sectors, including Finance, thanks to its long lasting consulting presence in the industry, recent international specific acquisition, and external strategic alliances. Our professionals hold the best Financial Engineering Certifications (e.g. CQF), periodically publish in specialized industry journals (e.g. Fondi&Sicav) and are lecturers in Financial Data Science masters (e.g. SIAT).

Case studies

The following applications show a set of success stories that use AI to support financial risk monitoring, quantification, and management, as well as trading and portfolio management.

Energy Commodity Risk Management

Bip xTech supported the Energy Risk Management team of an Italian multinational oil and gas company in monitoring the risk of business portfolios designing and implementing multiple algorithms for the calculation of Value-at-Risk and Profit-at-Risk indices.

The set of algorithms are industrialized in a software solution deployed on the on-premises client’s Big Data Platform and optimized to speed up the model inference time.

RESULTS

- Multiple implementation of VAR for risk management team

- +300: commodities involved in the calculation, leveraging on Big Data Technologies

- Custom front-end for results visualization and what-if analysis

Soft commodity yield prediction

For a Commodity Trading Company, Bip xTech developed an analytics model to predict the yield of various soft commodities (e.g. corn, hazelnut, etc.) in order to support the client in the optimization of trades and portfolio management.

The prediction tool leverages on a set of Machine Learning models to estimate yield for different time and space granularity prior to the harvesting period. The tool leverages market and alternative data (e.g. weather forecast) and is integrated with the company’s systems to automatically produce predictions and continuously update models.

RESULTS

- < 1% average error

- Increasing performances with a monthly rolling forecasting

- Embedded fast sensitivity analysis

Early detection of emerging trends and unknown unknown risks

In the realm of market dynamics, there are unknown unknowns, things with don’t know we don’t know. To try to sketch out those elusive factors that escape awareness or comprehension, Bip xTech and the Risk Department of an International Bank developed a model for early detection of emerging trends on newspapers to stay ahead of emerging market trends and risks. The project is aimed at resolving an unsupervised task, to discern emerging patterns and trends from various unstructured data sources, such as newspapers, without explicit guidance, enabling it to uncover valuable insights and trends that might not be apparent through manual analysis. The model leverages on NLP, Deep Learning techniques on several data sources, combining topic extraction and sentiment analysis. The extracted entities are labelled with timestamp, enabling advanced Time Series Analysis.

RESULTS

- Early detection of impactful events

- Enabling risk managers to swiftly respond to unforeseen events and swiftly adopt preemptive hedging strategies

- Versatile tool extends its utility to portfolio managers, facilitating the identification of burgeoning market opportunities

Conclusions

In this article we deeply examined the power of Machine Learning in Finance to achieve better performances in terms of potential revenues and risk exposure.

After a quick recap about credit risk management and current approaches to credit risk, we’ve looked closely at how BIP xTech uses advanced Machine Learning to predict corporate financial distress. The new approach outperformed traditional methods like the Altman z-score, leading to a more suitable model for Italy’s unique business landscape, mainly composed of Small and Medium Enterprises.

BIP xTech’s solution includes carefully choosing Machine Learning models, preparing data thoroughly, and fine-tuning the process. The result is a strong and clear model that predicts financial troubles accurately. In a real-world test with Italian companies, BIP xTech’s model proved its worth, helping lenders make better decisions, reducing mistakes and encouraging responsible lending while lowering financial risks.

BIP xTech stands as a valuable partner in the financial sector, offering extensive expertise in Artificial Intelligence, Data Science and Hyperautomation. Our capabilities extend beyond traditional structured data, encompassing unstructured data sources as well like images and webpages. With a proven track record, BIP xTech provides financial institutions with tailored solutions that leverage the most innovative techniques, enabling more informed decision-making and more benefits to its customers. Our commitment to innovation and adaptability makes us a trusted ally for navigating the rapidly evolving landscape of finance.

AUTHORS

Andrea Casati

Director Data&AI Financial Services

@BIP xTech

Niccolò Silicani

Senior Data Scientist Financial Services

@BIP xTech

Read more insights