AUTHORS

Giambattista Capirchio

5G Network Architect @ Bip xTech

Giulio Gnoato

Principal @ Bip xTech, Telecommunications Networks expert

The introduction of 5G has so far mainly concerned consumer services, but some technological factors and the possibility of access to the radio spectrum for private companies available in some countries are helping to create the conditions for a strong growth of 5G services within Enterprises. Mobile private networks, or MPNs, and the multiple IoT use cases they can support to improve the efficiency of production processes are certainly the best example of the benefits that 5G can bring to the business world.

5G for the Enterprise

The commercial 5G service is now widely available: according to the latest GSMA data published in January 2022, it is present in 70 countries with further activation of commercial networks already planned. The situation is very heterogeneous both at the level of geographic areas – North America, Europe, China, South Korea and Japan further ahead in deployments compared to other areas such as Latin America and Africa – and within the individual countries where the coverage offered with dedicated bands is still mostly limited to urban areas. However, the growth estimates are very strong and it is expected that the number of 5G connections will triple by 2025 compared to 2021, reaching a global percentage of 25%. Also, according to the GSMA, by 2030 5G will contribute 960 billion dollars to the global economy with the services, manufacturing and utilities sectors benefitting most from this contribution thanks to the specific use cases that can be implemented.

Juniper estimates global spending of $ 12 billion in private mobile networks in 2023 with most of the spending going to networks with 5G technology. A value that is not particularly significant when compared to the overall expenditure forecasts for the deployment of public networks, but which certainly represents the sign of a growing 5G market for Enterprises.

Enabling factors

The reasons for the development of this market are to be found in the various components that make 5G particularly suitable for solutions designed specifically for the business world. One of the determining and most distinctive factors compared to previous generations is certainly the capacity of traffic segregation guaranteed by the introduction of network slicing, or the possibility of dynamically allocating portions (or slices) of the network capable of satisfying multiple and specific requirements of safety and performance while using shared resources. This allows to satisfy a large number of use cases with very different requirements through the use of a common infrastructure and ultimately to provide differentiated services for the verticals satisfying the specific needs of each type of service. These are requirements that very often include low latency and high reliability, made possible by the different scenarios introduced in 5G, in particular we recall the availability of the Ultra-Reliable and Low-Latency Communications (URLLC) profile, and by distributed architectures with local breakout and edge functionality computing, i.e. respectively the termination and local processing capacity of data traffic that contribute significantly to reducing latency. Edge computing is already partially available in 4G architectures as an additional functionality, but in the 5G context (where it has been dubbed Multi-access Edge Computing (MEC)), it is natively supported thus allowing greater integration between the application functions executed locally and the mobile network.

Another crucial aspect for enterprise adoption is the downscaling of costs resulting from a combination of factors:

- the emergence on the market of new players in the context of Open RAN solutions, which have the advantage of increasing market competitiveness thanks to the possibility of creating multi-vendor access networks;

- virtualization of network functions which allows to reduce implementation costs by exploiting the intrinsic characteristics of flexibility and scalability of the cloud.

Hybrid solutions of enterprise grade private mobile networks are increasingly emerging that can be partly distributed on the cloud, generally with regard to the control functions that are less affected by the greater latency and partly located on-premises, therefore able to combine the cost reduction benefits of the cloud with the guarantee of very low latencies thanks to the local management of data traffic flows.

Vertical IoT use cases

Among the use cases that can most benefit from the use of a private mobile network with the characteristics of 5G we find all mission-critical applications, i.e. those that are critical for the management of production processes and therefore require a high degree of reliability and low latency. In the manufacturing sector we highlight all automation applications using robots or cobots (collaborative-robots) that require centralized control for effective coordination in which the reliability of communications and response times to the commands transmitted are fundamental factors for safety and the quality of production processes.

In the utilities sector, but more generally in all those sectors that provide for field service activities, we also find all the augmented (AR) and virtual (VR) reality applications that allow to increase the efficiency of maintenance and on-site intervention activities through augmented reality collaboration tools with expert staff who can remotely support and guide in the management of complex problems. This type of applications requires high transmission bandwidth and low latencies to ensure a satisfactory user experience.

In the energy utilities sector we find Smart Grids, the set of all those applications aimed at making electricity distribution and transmission networks more “intelligent” through automation and remote control of the infrastructure requiring very low latencies (in the order of milliseconds) and the massive use of sensors for environmental and functional monitoring of the infrastructure. Then there are the applications of Smart Energy aimed at managing the flows of electricity which, with the growth of renewable energy and with the emergence of new models of consumption and distributed production of electricity, are becoming more flexible and bidirectional, requiring a strong automation for real-time network management. The requirements for these applications are very stringent and diverse: low latency, high reliability and security for remote control and network automation, and a high number of connections for the massive deployment of IoT sensors. Due to this heterogeneity of requirements, they would greatly benefit from the possibility of segregating the portions of the network dedicated to the different applications given by network slicing.

Then there are a whole series of other use cases that can be implemented ranging from the use of drones for infrastructure inspection and safety applications with automated driving or remotely controlled in driving beyond the line of sight (BVLOS) mode, to predictive maintenance applications or networks of sensors for monitoring production assets with the aim of detecting operating anomalies in advance through the use of machine learning and artificial intelligence algorithms and thus reducing the risk of failures and malfunctions with impacts on production processes.

MPN operating models

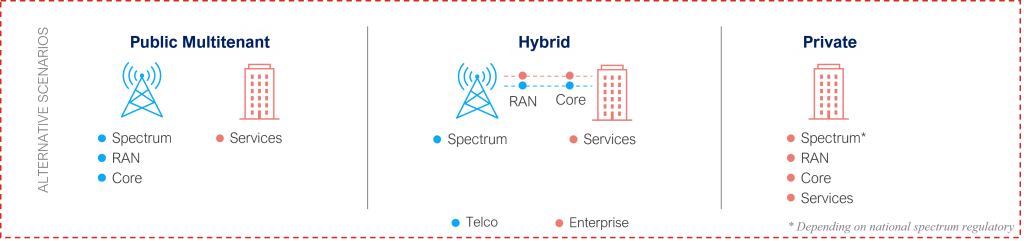

There are different MPN implementation models (see Figure 1) which are distinguished according to economic and operational requirements and the level of infrastructure control and dependence on telco operators.

Figure 1 – MPN operating models

The Public Multitenant model uses an entirely public infrastructure, with licensed spectrum, in which a virtual portion of resources is dedicated to the enterprise. Typical examples of this model are the classic APN with dedicated gateway which in more advanced models can be distributed and located in the enterprise data centers or in the case of 5G it can be made up of a dedicated slice. It is the model with the least complexity of implementation and with the lowest level of protection of the confidentiality of corporate data and involves total dependence on public operators.

The Hybrid model combines a portion of public infrastructure with a private portion owned by the enterprise making use of the public licensed spectrum. A typical example of this model are the architectures in which a private core network relies on public radio access but there may be several other nuances with different levels of direct implementation by the enterprise rather than the use of public infrastructures for the realization of the solution. This model is valid for those companies that seek a greater level of autonomy and control over the management of the network, the implementation of services and greater confidentiality in the transport and management of company data.

The Private model on the other hand uses a completely private infrastructure with a spectrum that can be publicly licensed or shared for private use according to the existing regulations in the various countries, even if in countries where the spectrum is assigned exclusively to public operators, the model does not seem at the moment be very successful. This is undoubtedly the choice that guarantees total independence from telcos in the management and control of the entire network, allows a high level of customization of the solution and related services but involves greater complexity of implementation, greater investments and requires specific internal skills if the enterprise does not want to entrust the management of the network to an external service provider.

Use of the spectrum and market

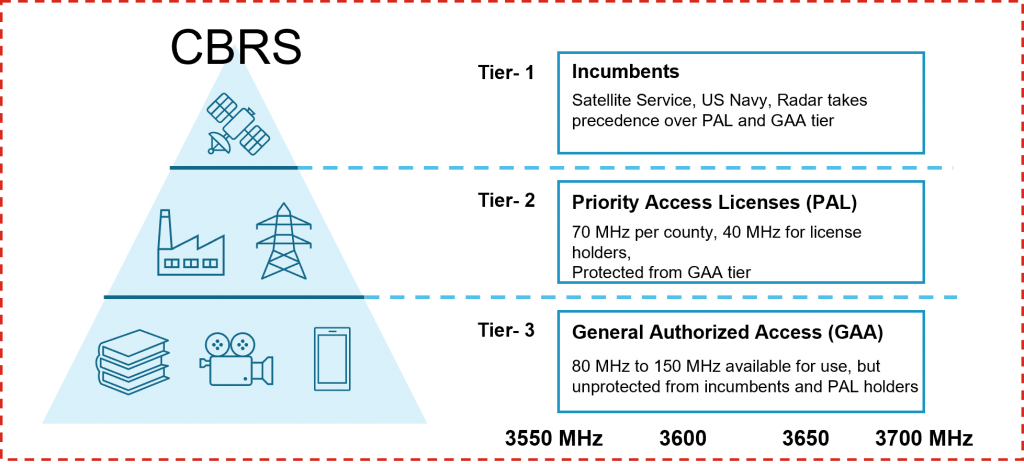

As mentioned above, the availability of spectrum for enterprise use is a factor that is pushing the market for private mobile networks in several countries as it allows for the implementation of completely private and independent from public operator solutions. In the United States, since 2017 the Federal Communications Commission (FCC) has allocated a portion of 150 MHz of band (3550-3700 MHz) for commercial use by individuals called Citizens Broadband Radio Services (CBRS). To regulate access to the spectrum and coexistence with radar and satellite systems belonging to the Defense, a framework was created that groups users into three different categories with decreasing access priority levels: Incumbents, Priority Access License (PAL), General Authorized Access (GAA) (see Figure 2).

Figure 2 – CBRS spectrum access framework (Source AWS)

Particularly interesting is the case of some energy companies such as San Diego Gas and Electric (SDG & E), Southern California Edison (SCE), Alabama Power just to mention those that invested the most to acquire PAL licenses (via the tender held in 2021) in the various counties in which their transmission and/or distribution network unfolds, most likely to have the possibility of creating completely private geographic networks, therefore able to support the development of the multiple use cases that we have seen previously.

Other countries such as the UK and Germany, despite having different regulations from the US, still allow access to the radio spectrum for localized private use and with very limited costs, making the 3,800-4,200 MHz band available in the UK and the 3,700-3,800 MHz band in Germany. In Brazil, Anatel[1] has recently concluded a public consultation on the technical and operational requirements for the coexistence of low-power transmission base stations with satellite systems operating in the 3,700-3,800 MHz band. In France it was announced in recent weeks the possibility for various industrial sectors to directly access the spectrum in the 3,800-4,000 MHz band to carry out experiments on possible use cases, expanding what was already the availability of resources destined for verticals in other frequency bands.

This wide availability of low-cost spectrum is almost certainly having a decisive influence in the definition of solutions for completely private mobile networks, with more and more availability of products designed for use in enterprises. With this in mind, last November AWS launched “AWS Private 5G” in the United States, a 5G private network mainly implemented on a cloud platform and provided as a paid service based on the required capacity and throughput. Other technology manufacturers, very active in the vertical solutions sector but not traditionally present in the radio access network market, such as Cisco and HPE, are launching similar services, also adding the ability to manage 5G networks and Wi-Fi networks simultaneously. Generally, these solutions take advantage of the possibilities offered by Open RAN to virtualize and combine radio access components provided by different technology vendors. Network-in-a-box solutions have also been launched, with the functionality of a mini Core and Edge enclosed in a single server, whose simplicity of installation and management are enhanced with the aim of making the user experience similar than that of a classic enterprise Wi-Fi network.

In Italy, in 2021 a public consultation was conducted by AGCOM to evaluate new ways of using the spectrum at the service of enterprises, but the results of the survey led AGCOM to maintain the current regulatory framework which provides for the sole possibility of spectrum leasing in the 3,600-3,800 MHz band assigned in the 2018 5G tender to public operators. This difference compared to other countries could partly explain the orientation of the market, with private solutions not easily accessible for enterprises given a greater propensity of operators towards public multitenant or hybrid models.

Conclusions

Private mobile networks, generally marketed as Mobile Private Networks (MPNs), are not an absolute novelty. They have already existed for several years based on 4G technology but the functionalities introduced by 5G and the availability of spectrum reserved for private use, mainly in those countries that allow it, are making them a solution that can be easily adopted by companies that need connectivity in areas with poor public service coverage or that want to have a wireless infrastructure capable of replacing most of the pre-existing connectivity solutions to manage the different IoT or IIoT use cases.

Bip xTech and 5G

xTech is a center of excellence of the Bip Group, with a long history in the definition of strategies, service analysis, design and governance of TLC solutions.

The new use cases that 5G will enable at the level of private networks, of OT and IoT solutions, of services to end customers will have to be analyzed keeping in mind the business objectives, the market and the rapidly changing technology and always with a look at how enhance and integrate company assets.

We are, as always, alongside our customers to help them seize the opportunities offered by 5G, also by virtue of our strong skills on Artificial Intelligence and Cloud, which will increasingly merge with transmission technologies to revolutionize the range of services a arrangement of companies.

If you are interested in learning more about our offer or would like to have a conversation with one of our experts, please send an email to [email protected] with “5G Enterprise” as subject, and you will be contacted promptly.

Note

[1] Agência Nacional de Telecomunicações, the government agency for the regulation of the telecommunications sector

Read more insights